What Is Stamp Duty Land Tax (SDLT)?

Stamp Duty Land Tax is a tax on the acquisition of land in England and Northern Ireland. Scotland charges Land and Buildings Transaction Tax and Wales charges Land Transaction Tax, instead of SDLT. This page will outline and discuss the main points relating to stamp duty on commercial property.

What Is SDLT Charged On?

SDLT is charged on land transactions in England and Northern Ireland according to the price paid or in some cases the market value. A land transaction is any acquisition of a chargeable interest. This includes not only freeholds and leases, but also interests, rights and powers over land other than exempt interests such as mortgages and licenses to use land.

Do You Need to Pay Stamp Duty on Commercial Property?

Yes, stamp duty is payable on the acquisition of commercial property and residential property. Stamp duty on commercial properties is payable at the rates in Table B (see below). Stamp duty on commercial properties is charged at the rates in Table B where the land consists of or includes land that is not residential.

Is Stamp Duty the same for Residential and Commercial Property?

No, the headline rates of stamp duty for commercial property are lower than for residential property. However, the effect of the nil-rate bands in the various tables of rates for a residential property, including the stamp duty “holiday” until 30 June/30 September 2021 and reliefs such as those for multiple dwellings relief should be considered when comparing the total amount of SDLT payable.

You can read more about the latest updates relating to the stamp duty holiday on the HMRC site here

What Are The Rates for Stamp Duty on Commercial Property?

Where the land consists of or includes land that is not residential property, the percentages in Table B apply:

Table B: Non-Residential or Mixed

| Relevant consideration | Percentage |

|---|---|

| So much as does not exceed £150,000 | 0% |

| So much as exceeds £150,000 but does not exceed £250,000 | 2% |

| The remainder (if any) | 5% |

If the transaction forms part of a number of linked transactions the relevant consideration for the purpose of the table above is the total of the chargeable consideration for all the linked transactions.

Do You Pay Stamp Duty on Commercial Leases?

Yes, Stamp Duty Land Tax is charged in respect of leases on any premium paid for the grant of a lease and also on any rent. Lease premiums on leases of commercial property are taxed in accordance with the rates of SDLT in Table B (see further above) and SDLT on the rent is calculated according to the special formula described below.

How is Stamp Duty Charged on the Rent for Commercial Leases?

Stamp Duty Land Tax is charged on any chargeable consideration consisting of rent as a percentage of the net present value of the rent payable over the term of the lease.

In other words, the total rent payable over the term of the lease is in principle charged to tax (after discounting each annual rent by 3.5% per annum to arrive at its present value). This contrasts with Stamp Duty on rent that was charged on only one year’s average rent at varying percentages according to the term of the lease. On average, the SDLT charge on rent when it was originally introduced represented an increase of four times the Stamp Duty charge on a ten-year lease.

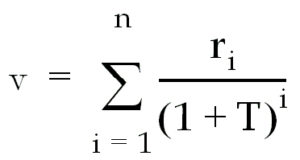

The net present value (V) of the rent payable over the term of the lease is calculated by applying the formula:

ri is the rent payable in respect of year ‘i’

i is the particular year for which the calculation is to be performed (a calculation is required for each year)

n is the term of the lease

T is the temporal discount rate (currently 3.5%)

Having calculated the net present value of the rent (referred to as the ‘relevant rental value’) the tax is charged as a percentage of so much of that value as falls within each rate band in Table B (please see above).

Are there any Stamp Duty Exemptions and Reliefs for Commercial Property?

Yes, there are stamp duty exemptions and reliefs for sales and leasebacks, dwellings acquired from relocated employees, compulsory purchases, incorporation of limited liability partnerships, and seeding reliefs for PAIFs and COACS to name a few.

Further Advice

If you have any questions or need advice about SDLT on commercial property contact Patrick Cannon now.

Frequently Asked Questions

Get In Touch

For professional and insurance reasons Patrick is unable to offer any advice until he has been formally instructed.