Tax Evasion Statistics UK 2018-2020

The following information has been researched and put together by Patrick Cannon to provide an up-to-date and current page of all UK 2018-2020 tax evasion statistics.

Key Tax Evasion Statistics

The Volume of fraud cases drops to a record number

2020 saw a record fall in the volume of recorded tax fraud, including tax refunds, evasion of duty, evasion and VAT fraud. It fell by 93% from 2019 to 2020, from £721 million to just £54 million. There was a 51% drop in the volume of cases in 2020 as opposed to 369 in 2019.

- £4.6 billion of the UK “tax gap” is due to tax evasion

- Around £70 billion of revenue has been lost to tax evasion overall in the UK

- 73,000 people reported UK tax evasion hotline in 2019-2020

- Income tax accounts for as much as 23% of the government’s total revenue

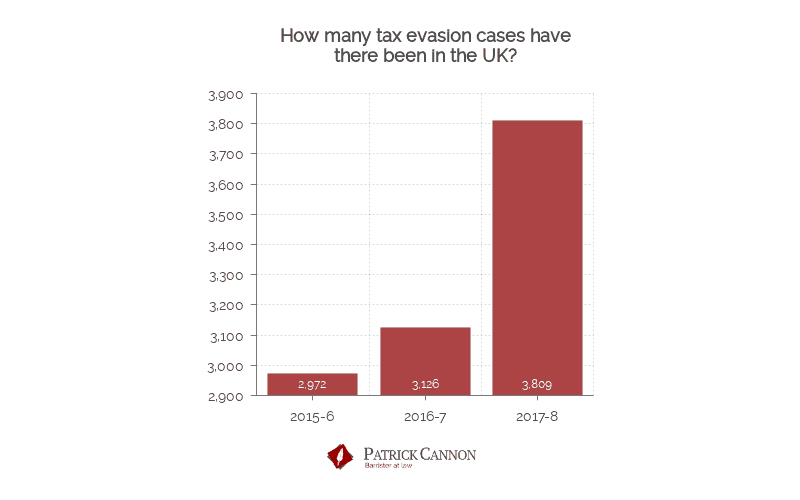

How Many Cases of Tax Evasion Have There Been in the UK This Year?

During the 2017 to 2018 financial year, there were a total of 3,809 tax evasion cases recorded.

Records of tax evasion stats suggest that the number of cases brought to light has been increasing, with 593 more arising since the previous financial year (2016 to 2017) and 837 more now occurring than were recorded in 2015 to 2016.

This leaves us with a total of 9,997 tax evasion cases taking place over the last three years. Broken down into the following:

- There have been 3,809 known tax evasion cases in the UK in the financial year 2017/8

- There were 3,216 known tax evasion cases in the UK in the financial year 2016/7

- There were 2,972 known tax evasion cases in the UK in the financial year 2015/6

Tax Evasion Offenses in 2019-2020

548 individuals were charged for tax evasion in 2019 – 2020.

Overall, in 2019 fraud investigations have led to the conviction of more than 600 individuals for their part in tax crimes.

Furthermore, new criminal investigations into more than 610 individuals have been launched during the last 12 months.

Tax crime tightens as 250 taxpayers are investigated by HMRC for serious tax evasion

- In March 2020, 250 taxpayers including 23 of the largest businesses in the UK were reported to the evasion teams.

- An additional 4.4 billion in revenue will increase over the next 5 years as the Government pledged extra funding.

- An HMRC spokesperson said, “Our role is increasingly about making it straightforward for taxpayers to get it right, first time, while also tackling the minority who deliberately set out to cheat the system.”

Many of the individuals prosecuted for tax-based crimes were found to be company directors, accountants and organised criminals – each of whom tend to handle large financial assets.

Tax Evasion Case Study: EX-BHS OWNER DOMINIC CHAPPELL JAILED FOR TAX EVASION

- In November 2020, Dominic Chappell was sentenced to six years in jail due to dishonestly evading tax by cheating the public revenue.

- Following a 4 week trial at Southwark Crown Court, Chappell was found guilty of failing to pay around £584,000 in tax on income he received after buying the failed BHS chain for £1 in March 2015.

- According to HMRC investigations, during a 17 month period, sales invoices for this period totalled 2.3m resulting in liability for a VAT payment of £351,944. Chappell only paid £8,433.

- In addition, Chappell failed to inform HMRC of a £330,000 dividend he received from Swiss Rock Ltd. He also only paid £10,000 in corporation tax, a small fraction of the £164,064 he owed.

- In sentencing, the judge, Mr Justice Bryan, said Chappell had engaged in a “long and consistent course of conduct designed to cheat the revenue”.

Simon York, director of the Fraud Investigation Service at HMRC said of the court’s ruling, “Today’s result sends a clear message to the minority who commit tax crime that no matter who you are or what resources you have at your disposal, no one is beyond our reach.”

Both domestic and global initiatives have now been put in place to tackle offshore tax evasion, with a combined £2.8 billion having been spent on their investigations since 2010.

Many of the individuals prosecuted for tax-based crimes were found to be company directors, accountants and organised criminals – each of whom tends to handle large financial assets.

What is the Cost of Tax Evasion in the UK?

HMRC reported in June 2019 the total tax gap at £31 billion for 2018/19, representing 4.7% of total tax liabilities.

Throughout the tax year running from 2018 to 2019, the total cost of tax avoidance came to approximately £1.7 billion, while tax evasion was around £4.6 billion within the same time frame.

HMRC has estimated that £4.6bn in tax revenue was lost to evasion in 2018/19.

£3 billion has so far been recovered from perpetrators of offshore tax evasion in just under a decade.

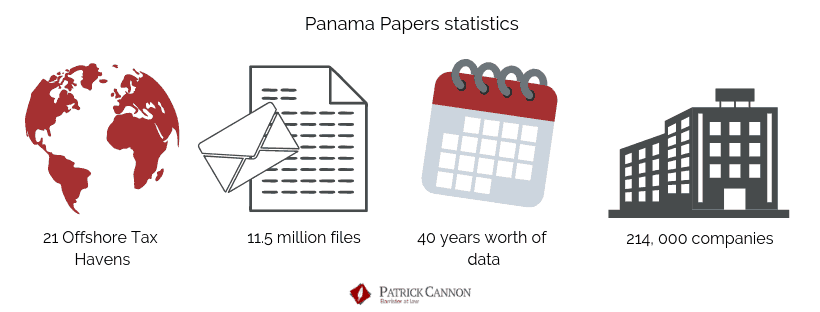

Panama Papers Statistics

The “Panama Papers” constituted the biggest tax evasion case in history and resulted in a global scandal. In total, they involved more than 40 years’ worth of data relating to tax fraud.

The case involved 11.5 million files, 4.8 million of which were emails and 1 million of which were images.

It truly was a worldwide matter, with the names of people and institutions based in 200 countries and territories mentioned within the files, and more than 214,000 companies and 21 offshore “tax havens” being investigated as a result.

Of these, 113,000 – more than half of the companies scrutinised throughout the case – were incorporated in the British Virgin Islands and the scheme involved more than 14,000 clients and recipients overall, including 109 media organisations.

How Many Tax Fraud Cases Are Reported in the UK?

The HMRC hotline where members of the public use to report suspected fraudulent behaviour relating to tax evasion averages around 200 calls every single day.

HMRC had received 73,000 whistleblowing reports in 2019/20, 10% more than in the previous year.

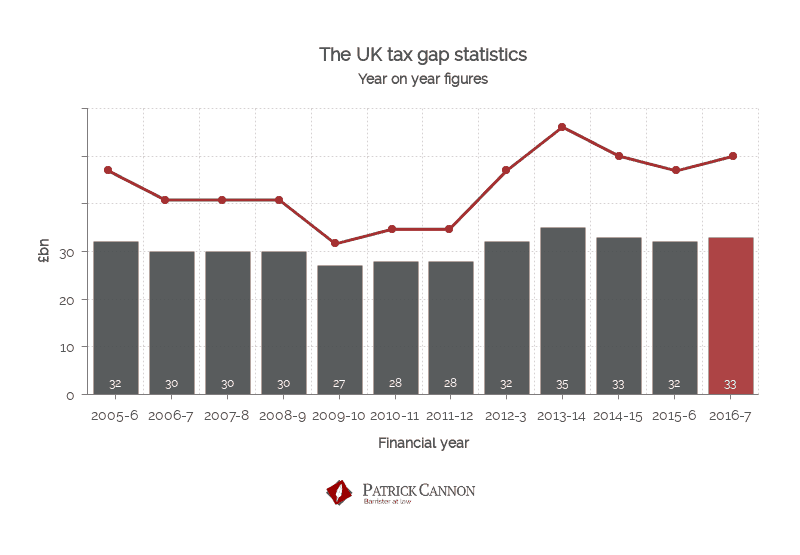

UK “Tax Gap” Statistics

What is the ‘tax gap’?

The phrase “tax gap” refers to the difference between the amount of tax that should be paid to HMRC each year and the amount that is received by the government.

The tax gap in the UK is currently estimated to be worth about £31 billion, which is 4.7% of tax liabilities (lowest recorded rate). Around five per cent of the total amount is thought to be due to illegal tax evasion.

Throughout the years 2018-19, the gap has reduced by around £2 billion since it was last measured in 2017. The gap is decreasing. Since 2005, the size of the gap has reduced from 7.3% to 4.7% in 2019.

Reasons for the UK Tax Gap

There are a number of reasons for the existence of the UK tax gap, the majority of which involve fraudulent financial activity and tax evasion. They include:

- Tax evasion in the shadow economy

- Tax lost as a result of other criminal or fraudulent activity in the UK economy

- Capital Gains Tax and Inheritance Tax evasion

- Offshore tax evasion

- Tax evasion on investment and rental income

- The failure by HMRC to bring criminal prosecutions for tax fraud in order to set an example to would-be tax cheats who thereby feel emboldened to cheat

Breaking matters down further, investigations have concluded that: (2018-2019)

- £13.4bn is estimated to come from small business

- £5.3bn is estimated to come from large business

- £4.5bn is estimated to come from criminals

- £3.7bn is estimated to come from medium businesses

- £2.4bn is estimated to come from individuals

What missing tax makes up the tax gap?

- £12.1bn is estimated to come from Income Tax, National Insurance Contributions (NICs) and Capital Gains Tax

- £10bn is estimated to come from Value Added Tax (VAT)

- £4.4bn is estimated to come from Corporation Tax

- £2.8bn is estimated to come from excise duties

- £1.7bn is estimated to come from other taxes

What are the reasons behind the tax gap?

- £5.5bn has resulted from the failure to take reasonable care

- £4.5bn is from criminal attacks

- £4.9bn is from legal interpretation

- £4.6bn is from tax evasion

- £3.1bn comes from errors

- £2.6bn is from the hidden economy

- £1.7bn is from tax avoidance

UK Undeclared Earnings Statistics

Of the 66.57 million people residing in the UK, 5.7 million fail to declare earnings made through what has become known as “side hustles” – ventures undertaken outside of our main employment, such as selling items online or taking on freelance work. It’s not commonly known that individuals are expected to pay taxes on their extra earnings, but if the total amount earned values at over £1000 – the money becomes a taxable asset. This regulation is not necessarily well communicated and may contribute to the vast amount of Brits not paying tax on their ‘side hustles’.

This unknowingness has led to an estimated total amount of £23.5 billion being earned throughout 2017 without being correctly taxed.

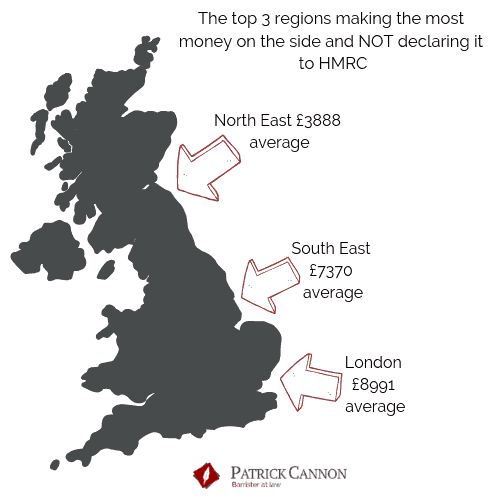

Regional Break Down

London is home to the highest percentage of individuals who fail to declare an amount of their income, with 30.9% of them doing so. On average, residents of this region earn around £8,991 without paying tax.

London is followed by the North East (26.5%) and the North West (12.4%). As for how much money was being made off the books, Londoners again top the ranks at £8,991.36, followed by East of England at £7,370.82 and the North East at £3,888.60.

Gender Break Down of Undeclared Earnings

What percentage of men and women make money on the site and do NOT declare it to HMRC?

- 19% of men make undeclared earnings

- 8.3% of women make undeclared earnings

19% of men make undeclared amounts from a “side hustle”, and the average man fails to declare around £4,571 of his income – while 8.3% of women take on undeclared work on the side and the average woman takes home £3,091 worth of untaxed finances.

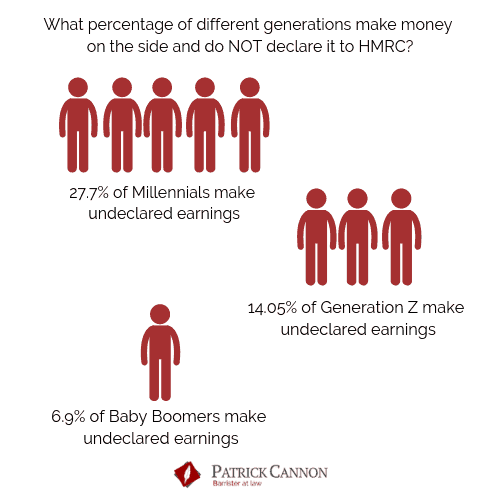

Generation Break Down of Undeclared Earnings

The generation who fail to declare the highest amount of taxable income are millennials. 27.7% of people within this age group (made up of people born between 1981 and 1996) make money and fail to declare it, meaning this is the largest percentage of any generation to commit this type of financial crime.

Generation X – people born between 1965 and 1980 – see 14.05% of their generation failing to declare any of their finances.

6.9% of Baby Boomers (those born between 1946 and 1964) fail to declare all of their income.

Get In Touch

For professional and insurance reasons Patrick is unable to offer any advice until he has been formally instructed.