SDLT can vary depending on the type of property and your circumstances. It is only paid on properties sold for £40,000 or more. A new consultation means that foreigners may have to pay more in the future. And, if a person buys 6 or more residential properties in one go (such as a buy to let landlord, for example) then the properties are treated as non-residential and they pay reduced stamp duty rates with a maximum of 5% compared with 15% for residential.

Plus, as house-prices vary so does the amount of SDLT that would need to be paid. Because of this, things are not always as meets the eye. You may look at a property and believe it to pay a large sum of Stamp Duty, but actually – it may pay very little, if any at all.

SDLT Overview

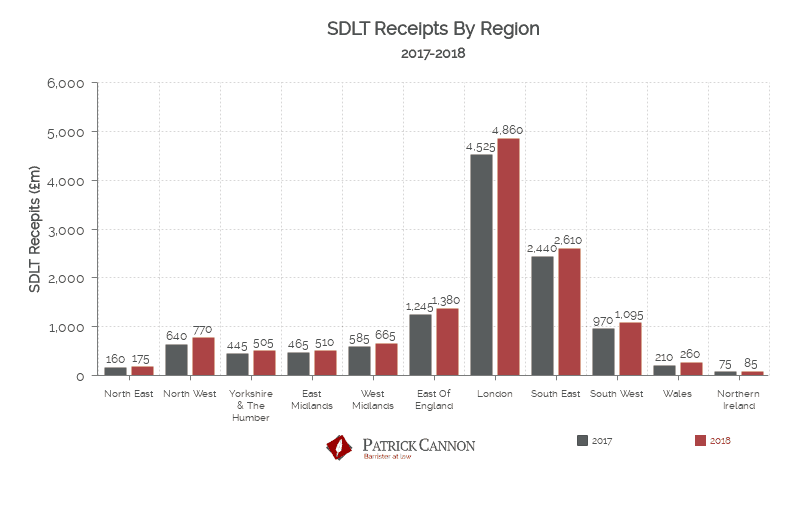

According to the latest bulletin, 97.3% of SDLT revenue in 2017-18 came from transactions in England (£12,565 million), with Wales and Northern Ireland accounting for 2% and 0.7%. Of those transactions in England – London contributed the most SDLT revenue, accounting for £4,860 million and 39% of total receipts. Properties that were sold for over £1 million accounted for a total of 3% of transactions and 44% of the total SDLT receipts.

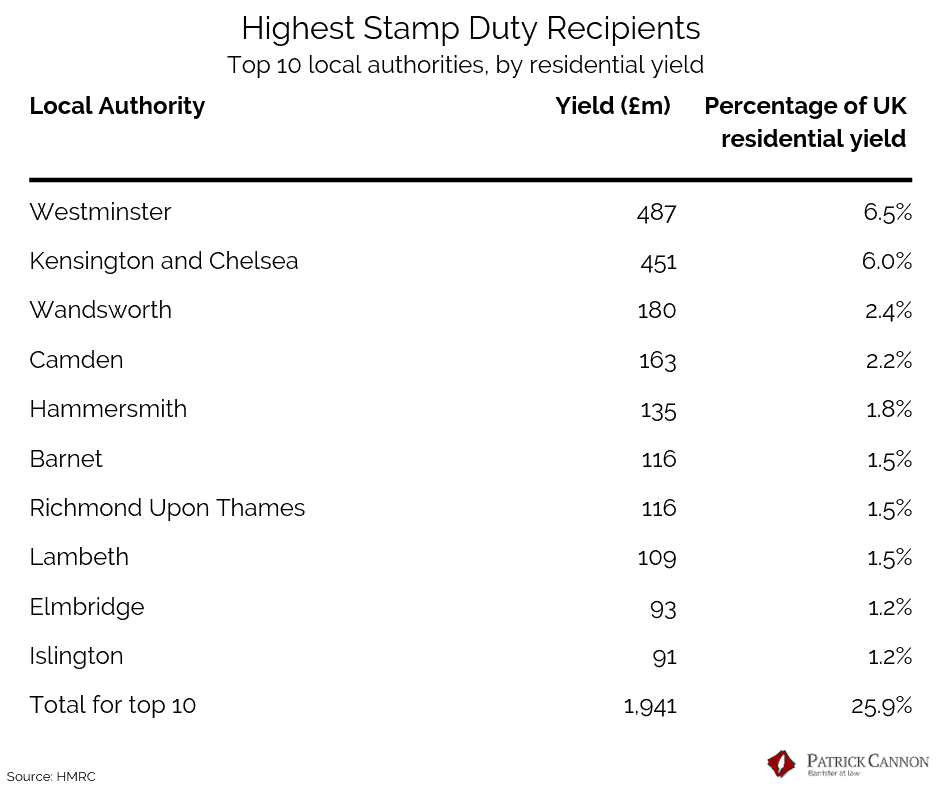

It was found in a study by The Guardian that property sales in 10 South East boroughs contributed over a quarter of the SDLT in 2014-15, accounting for almost £2bn. In the borough of Westminster, it was estimated that the Treasury made £487m from Stamp Duty payments, which represents 6% of total receipts from residential sales. Kensington & Chelsea came second, with £451m SDLT paid.

Outside of London, Elmbridge is one of the highest contributors – yielding around £93m in Stamp Duty.

This table outlines the top SDLT payers in the UK.

With this in mind, would you be able to work out the SDLT paid on the below properties?

Guess The Stamp Duty That These Properties Pay

How much SDLT does this 2 bedroom house in Gainsborough, Lincolnshire pay?

Photo: Auction House

1) £2,976

2) £0

3) £15,472

4) £24,530

How much SDLT does this 6 bedroom house in Notting Hill, London pay?

Photo: Alex Winship

1) £2,163,750

2) £864,800

3) £0

4) £56,432

How much SDLT does this 3 bedroom house in Pebble Beach, Whitburn, Sunderland pay?

Photo: Rightmove

1) £0

2) £11,497

3) £2,783,110

4) £75,250

How much SDLT does this 1 bedroom home in Leyton, East London pay?

Photo: Clive Emson

1) £12,340

2) £967,187

3) £24,760

4) £0

How much SDLT would you pay to buy-to-let these 6 one bedroomed flats in this block in Salford?

Photo: Zoopla

1) £34,500

2) £1,560,300

3) £0

4) £540,075

How much SDLT does this three bedroom home in Nantymoel, Wales pay?

Photo: Zoopla/UrbaneBrix

1) £35,000

2) £1,102,250

3) £0

4) £5,665

How much SDLT does this 5 bedroom home in Sandbach, Cheshire pay?

Photo: Rightmove

1) £52,750

2) £0

3) £2,560,885

4) £350,600

How much SDLT does a 2 bedroom flat in this property in Cambridge pay?

Photo: Zoopla

1) £0

2) £40,275

3) £245,100

4) £13,750

How much SDLT does this 6 bedroom end-of-terrace flat in Central London pay?

Photo: Rightmove

1) £35,900

2) £465,145

3) £2,883,750

4) £0

How much SDLT does this terraced house in Horden, Country Durham pay?

Photo: Chronicle Live

1) £0

2) £3,450

3) £18,000

4) £24,595

Answers

And here are the answers, some of which may be surprising.

Photo: Auction House

SDLT: £0

Home price: £15,000 (as of June 2018)

Photo: Alex Winship

SDLT: £2,163,750 (or £2,726,250 if a second home)

Home price: £18.75 million (as of Feb 2019)

Photo: Rightmove

SDLT: £11,497 (or £24,396 if a second home)

Home price: £429,950 (as of Feb 2019)

Photo: Clive Emson

SDLT: £0

Home price: £30,000 (as of June 2018)

Photo: Zoopla

SDLT: £34,500 or £5,750 per flat

Home price: £150,000 per flat (as of Feb 2019 according to Zoopla)

Photo: Zoopla/UrbaneBrix

SDLT: £0

Home price: £39,995 (as of March 2018)

Photo: Rightmove

SDLT: £52,750 (or £85,450 if a second home)

Home price: £1,090,000 (as of March 2018)

Photo: Zoopla

SDLT: £13,750 (or £28,000 if second home)

Home price: £475,000 (as of Feb 2019)

Photo: Rightmove

SDLT: £2,883,750 (or £3,626,250 if a second home)

Home price: £24,750,000 (as of Feb 2019)

Photo: Chronicle Live

SDLT: £0

Home price: £17,000 (as of August 2018)

Get In Touch

For professional and insurance reasons Patrick is unable to offer any advice until he has been formally instructed.