Key UK Inheritance Tax Facts

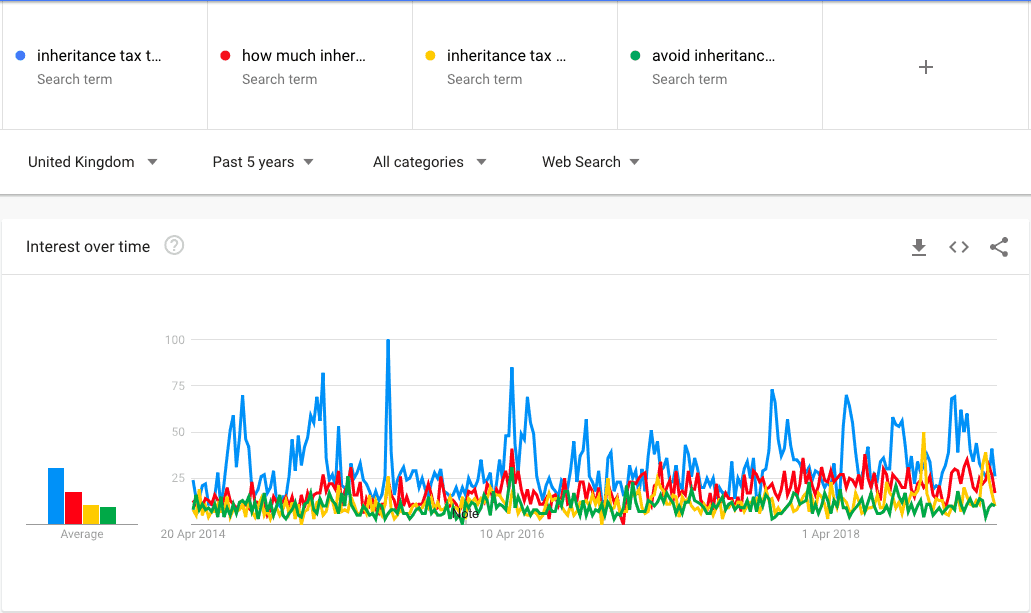

- Members of the UK public feel under-educated about Inheritance Tax. “How much is inheritance tax?” has 2,900 searches a month in the UK.

- Asset prices and the take from Inheritance Tax are growing each year. As a result, the term “avoid inheritance tax”, currently garners 720 searches per month in the UK.

- Inheritance Tax receipts totalled £5.2bn in 2017-18 – 8% greater than the previous year.

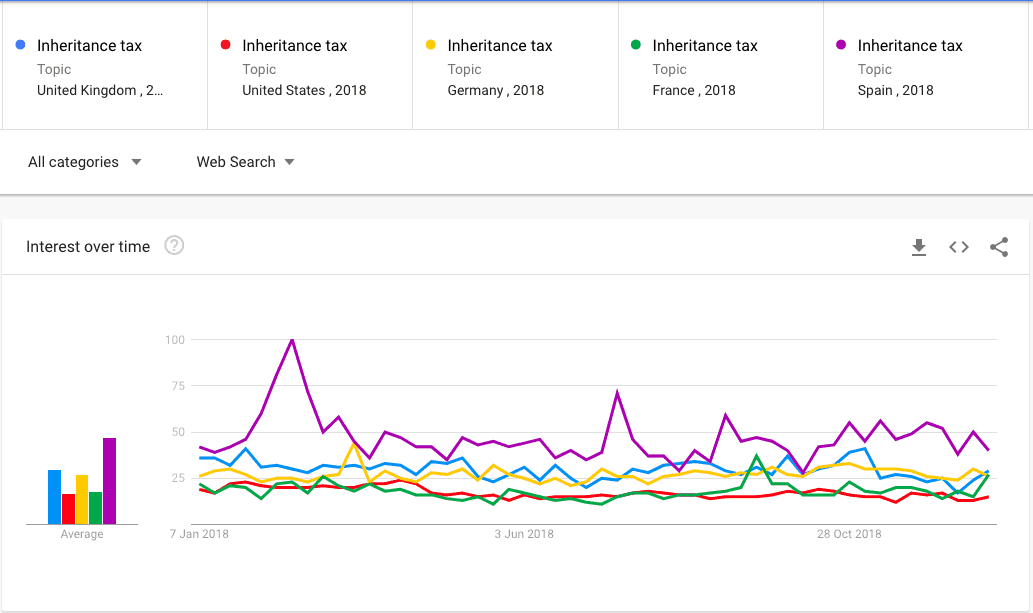

- The UK’s concern surrounding inheritance tax is greater than Germany’s France’s or the USA’s – second only to that of Spain.

- 51% of the UK’s total Inheritance Tax liability for 2015-16 was concentrated in London and the South East.

Inheritance Tax Threshold for 2019

What is the inheritance tax threshold for 2019?

The UK inheritance tax threshold in 2019-20 stands at £325,000. However, it appears that there is still some confusion regarding this matter, as evidenced by its steady upward trend in online searches.

The top five search terms over the last five years include “inheritance tax threshold” – which is by far the most popular – followed by “how much inheritance tax”, then “inheritance tax allowance” and finally “avoid inheritance tax”.

While search rates for “inheritance tax threshold” in 2019 are considerably lower than they were in 2015 – following years of significant spikes – it is still the most popular term.

UK Inheritance Tax: How Much Inheritance Tax is Paid?

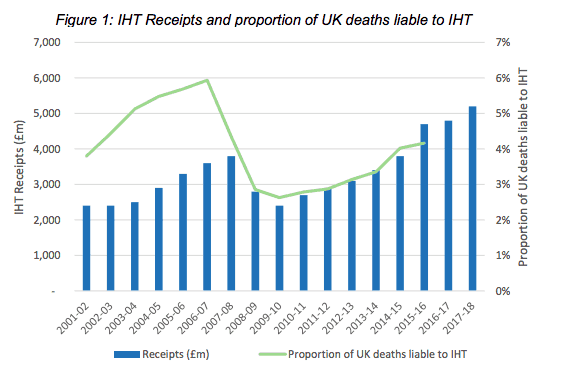

The most recent UK inheritance tax statistics reveal that the combined value of all UK IHT receipts has been steadily increasing since 2011, reaching £5.2 billion in 2017-18. This represents an 8% increase (£388 million) from the tax year 2016-17.

One of the most significant spikes within recent years was the increase from 2014-15 and 2015-16. That period saw an increase of 22%.

Inheritance Tax Exemptions and Reliefs

The “Nil Rate Band” – the amount at which IHT should begin to be paid – is also known as the Inheritance Tax Threshold. In 2019, this amount stands at £325,000, and has done for the last ten years.

Figures from 2015-16 reveal that, at that time, 47,900 estates had a net value exceeding this figure.

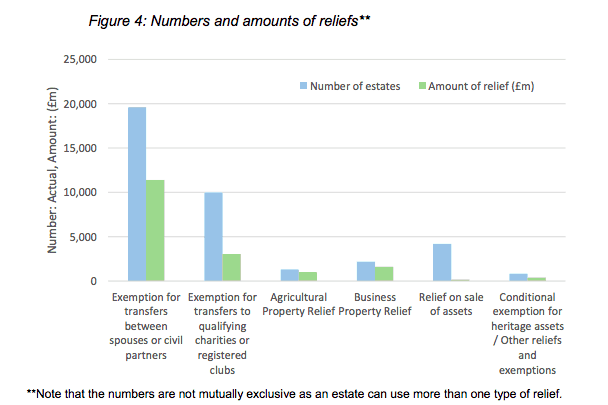

There are, however, a number of exemptions and reliefs available to estate owners and managers that can be set against the amount due.

At the time this data was recorded, the largest exemption amount was for transfers between spouses or civil partners, which totalled approximately £11.4 billion. It was taken advantage of by around 50% of estates that were liable to pay Inheritance Tax, but was worth around 65% of the total value of reliefs set against assets.

The next largest amount of relief consisted of transfers to qualifying charities. This was valued at £3.1bn and used by 10,000 liable estates.

The value of the aforementioned transfers has increased by around 16% on average per year since that time.

Other available exemptions and reliefs include Agricultural Property Relief, Business Property Relief, Relief on Sale of Assets and Conditional Exemption for Heritage Assets.

Inheritance Tax Due to HMRC

The standard rate of inheritance tax is 40% of any amount over £325,000. Each year, approximately 24,500 estates are required to pay this amount.

While the financial crisis saw a considerable drop in the number of estates liable for Inheritance Tax, rising property prices and stock market growth has seen that number rise again – with the number of UK deaths liable to IHT reaching 4.2% in the tax year 2015-16.

Inheritance Tax receipts hit their highest ever level in 2017-18, where their combined value exceeded £5,000 million – more than double that of 2009-2010.

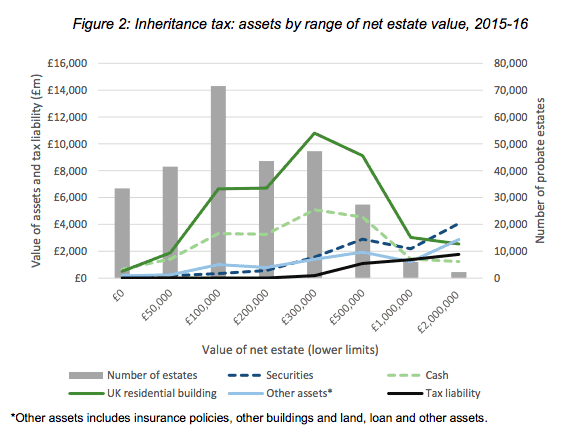

Despite only representing 1% of estates requiring a grant of representation, those with a net value of over £2 million accounted for 40% of the tax liability in 2015-16. Around 2,250 estates make up 13% of all gross assets.

The majority of the value of estates worth more than £2 million is made up of securities, insurance policies, other buildings and land, loans and other assets, while the value of estates worth less than £2 million tends to be tied up in residential property, or represented in cash.

As a result, reliefs like Agricultural Property Relief (APR) and Business Property Relief (BPR) tend to apply more to estates worth over £2 million which, in turn, tends to lower the average tax rate.

Up until the tax year 2014-15, the average tax liability was increasing year on year by 3% on average. However, in 2015-16, there was a decrease of £2,000 in the average liability per estate, which fell to around £179,000.

The main reason behind this change was the increase in the number of estates with a net value of between £1 million and £2 million. This group had a lower average liability (-£12,000).

As a result, total liability saw no change between 2014-15 and 2015-16.

Inheritance Tax Statistics by UK Region

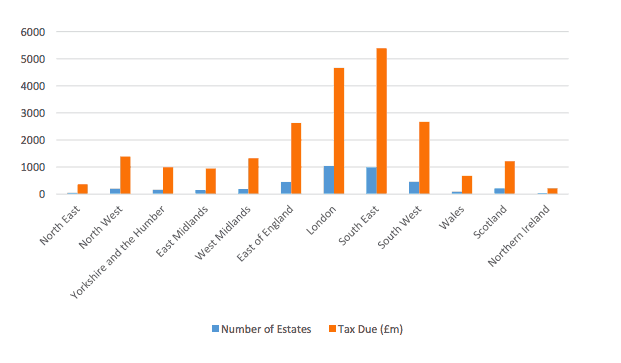

The largest number of IHT liable estates can be found in London and the South East. In 2015-16, the average London taxpayer was liable for £23,000 per estate. At that time, 51% of all IHT liability came from these two regions combined.

Northern Ireland and the North East of England were liable for the least amounts of Inheritance Tax, with averages of £127,000 and £132,000 respectively.

The town that contained the highest number of Inheritance Tax-liable families was Guildford, Surrey, followed by Chelsea, Wimbledon and South West London. At the time, 658 Guildford families were liable to pay Inheritance Tax, with an average amount of £231,000 owed per estate.

UK Estate Assets and Liabilities by Gender

47% of the owners of taxpaying estates by net asset value are male, though male-owned estates make up only 44% by numbers. However, 60% of total loans owed to an estate, along with a combination of other assets – from household and personal goods to farms, farmhouses and farmland, personal assets and foreign assets – are attributed to male estate owners.

Just over half of the collective mortgage debt value (at 52%) is also attributed to male estate owners. The average taxpaying male-owned estate had a net value of £1.1m and a tax liability of £182,000 as of 2015-16.

Female-owned estates are more likely to have lower tax liabilities than those that are male-owned – mainly as a result of the greater likelihood that a male spouse is more likely to predecease a female. If the estate is then bequeathed to the surviving spouse, spouse relief may be claimed.

As a result, IHT liable female-owned estates had a net value of £942,000 and a tax liability of £176,000 during the same period mentioned above.

UK Estate Assets and Liabilities by Age

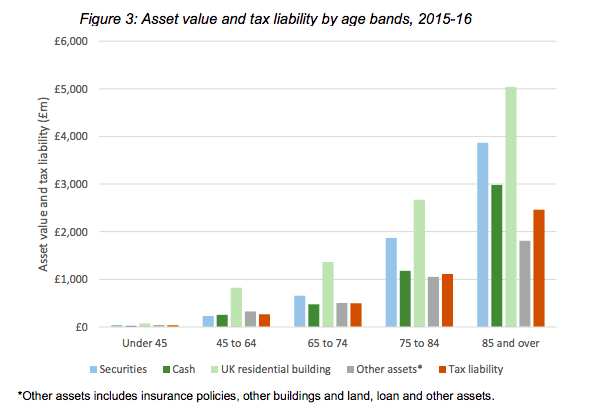

The value of estates liable for payment of Inheritance Tax tends to increase with the age of the estate owner at death. This is also the case with each estate’s tax liability.

Furthermore, the assets included in each estate are likely to shift in composition. While assets in the form of securities and UK residential buildings continue to be worth the most once the owner of an estate passes the age of 65, there tends to be more value found in cash-based assets than in insurance policies for owners who were older at the time of their death.

Inheritance Tax UK – 2019 Search Popularity

Compared to other UK taxes, inheritance tax attracts lower search rates. “Income tax” is the most popular search, followed by “tax exemption”. These two fields have seen the most significant increase in popularity over the last five years. Following these two areas come “capital gains tax” and “corporate tax” and finally “inheritance tax”, which experiences less than a third of the interest that income tax does.

Still less common are searches related to gift tax. 260 searches per month are made using the term “how much can you gift tax-free”? This subject is the most popular within the field in question.

Christmastime, in particular, shows a real lull in interest when it comes to inheritance tax.

However, since 2014, the following terms have increased in popularity by 5000%:

- “Labour manifesto inheritance tax”

- “HMRC inheritance tax address”

- “Inheritance tax estate report online”

- “Inheritance tax summary online”

Relevant current affairs and new events are the most likely factors to influence a spike in interest surrounding inheritance tax. The figures do not fluctuate seasonally, but cases such as that of the Duke of Westminster’s inheritance tax avoidance which came to light in 2017-18 tend to see a sudden rise in interest, then a quick drop off.

Searches related to “probate” – which refers to the legal right to manage property and possessions after a person’s death – tend to be more popular than those for “inheritance tax”.

This field has seen a number of queries rising fairly significantly, including searches related to the trend of moving probate applications online, “near me” searches and concern about probate fees. Overall, the most notable increases have been the following:

- “Probate fee increase” (5,000% increase)

- “New probate fees” (5,000% increase)

- “Find a grant of probate” (5,000% increase)

- “Probate solicitors near me” (5,000% increase)

- “Probate office near me” (4,750% increase)

- “Probate meaning” (600% increase)

- “Online probate application” (500% increase)

- “Apply for probate online” (300% increase)

Inheritance Tax Statistics: Global Concerns

Compared to Germany, France, Spain and the US, UK residents are the second most likely to search for information regarding inheritance tax. Spain’s use of this search term is around a third higher than ours. After the UK, Germany sees the next highest number of searches, with both France and the United States following some way behind.

Inheritance Tax Statistics: UK Tax Administration Concerns

A study of UK residents’ interests regarding inheritance tax, undertaken in 2018, concluded that the three main areas of concern are:

- Tax administration

- The complexity of rules relating to inheritance tax

- Wider perceptions of inheritance tax

Many respondents were not aware of the number of people in the UK who are liable to pay inheritance tax. 53% of the 3000 respondents asked were aware that that figure currently stood at 5%. However, 26% thought that the figure was 20% or more.

A number of those who took part in the study did not use a tax adviser when calculating their inheritance tax. 38% of these individuals spent 50 hours or more on the related administration. Furthermore, 65% said that – despite eventually finding out that they were not liable to pay the tax – they still had to provide significant amounts of information.

Only 11% of those who did not use an administrator found the process simple and user-friendly.

Interactions with HMRC were also found to be a cause for concern. Just 25% of all respondents said that receipt of their paperwork had been acknowledged by the authority, while 61% did not know how long it might take HMRC to respond to their submission.

While the Inheritance Tax Threshold currently stands at £325,000, as it has for the last ten years, the combined value of IHT receipts is gradually increasing. This has been the case since the financial crisis of 2008.

This rise is likely to be due to the increase in house prices and the rise in the value of stocks, shares and other assets. However, with more and more individuals becoming liable to pay Inheritance Tax every year, surveys and UK search results reveal that there is some confusion surrounding administrative aspects and probate.

Many people are unsure of whether they should be paying Inheritance Tax at all, while others struggle with the process of submitting their liability information to HMRC as the result of a lack of communication.

Get In Touch

For professional and insurance reasons Patrick is unable to offer any advice until he has been formally instructed.